PROPERTY TAX PROTEST

Help me in helping your neighbors by going to the Facebook Group I created solely for neighbors to discuss helpful information about property taxes or protesting. A place to share your stories and tips. Even a "today I went in and line was around the corner or took 5 minutes" etc. Hopefully, it can be an ongoing resource to also checkback next year to remind ourselves of the process.

or scan code

For more tips click below for our step by step

Protest Cheat Sheet & Presentation Excel Outline Updated frequently

2025

2024

See comparable explanation sheet below

2023

2023 Denton County Protest

Collin County Protest

2023 Workshops

Collin County ARB 2022 Protest

If you missed the other ways to lower your property tax bill click BACK to go to my Property Taxes Page- What, Why, How

UPDATES

2025

📍 DFW County Comparison – Protest Process:

| County | New Portal/System? | Informal Meetings? | Evidence Rules | Affidavit Required? |

|---|---|---|---|---|

| Collin | ✅ Yes – New portal at onlineportal.collincad.org | ✅ Yes — Must schedule in advance (QR code on notice) | Upload to portal, bring USB or paper; no smartphones; max 20MB per upload | ✅ Yes, if not attending or attending remotely |

| Denton | ➡️ Portal same, design updated (dentoncad.com) | ❌ Ended May 9 for residential; auto informal if scheduled hearing | Upload in Step 5, bring USB/print, no phones | ✅ Yes, if not attending or joining by phone/video |

| Dallas | ✅ Online protest via dcad.org | ✅ Yes — system encourages early resolution | Upload via portal or mail; evidence strongly encouraged before hearing | ✅ Yes, if not attending |

| Tarrant | ✅ tad.org with self-serve protest tools | ✅ Yes — No appointment needed; just walk in | Upload online or bring printed or USB evidence | ✅ Yes, if not attending |

New portal to efile is https://onlineportal.collincad.org you have to create a new account this year so have your 2025 Notice of Appraised Value sheet infront of you that has your Property ID and your EFile PIN

📞🎥 Attending Your ARB Hearing by Phone or Video? Here’s What You Do (and Don’t) Need in 2025:

✅ Good news — if you're attending your Appraisal Review Board (ARB) hearing in person, by phone, or via video:

-

You do NOT need a notary.

-

You do NOT need to fill out an affidavit if you're uploading your evidence through the CAD’s online protest portal (efile system).

-

If you're submitting evidence by email, fax, or dropping it off in person, you'll just need to include the simple Declaration of Evidence form (no notary required).

📝 Download the Declaration of Evidence form here

🛑 Not planning to attend your hearing at all?

Then you must submit the Affidavit of Evidence — and it does need to be notarized.

The ARB legally cannot consider your documents without it.

📝 Download the Affidavit of Evidence form here

See the 2025 Collin County Procedures here See their new how to videos here

DENTON COUNTY

Informal HEARINGS ARE OUT per their website that states:

Due to scheduling constraints, informal meetings are only available for Agricultural, Business Personal Property, and Commercial accounts at this time.

If you submitted a residential property protest and requested an informal meeting but were unable to schedule one before May 9th, an informal conference will still take place on the same day as your scheduled protest hearing, prior to the hearing.

Even though it still shows the link to schedule one at waitwhile.com/locations/dcad/welcome

If you don’t receive a Notice of Appraised Value, you can still view your property’s values using the public portal or the property search tool on their website. This links ot Denton Counties.

Homestead Exemption Audits Are Coming in Denton County

Starting in 2025, Denton CAD will begin verifying 20% of homestead exemptions annually under Senate Bill 1801. If you get a verification letter, don’t ignore it — you’ll need to re-submit documents to avoid losing your exemption.

🏠 Upcoming Change to the Texas Homestead Exemption

Heads up! Texas lawmakers have passed legislation to increase the school district homestead exemption from $100,000 to $140,000for most homeowners — and $150,000 for those age 65+.

✅ The increase was approved by the Texas Senate in early 2025.

🗳 It still requires voter approval in the November 2025 electionto go into effect.

📆 If approved, the new exemption amounts will apply to 2025 property tax bills (not retroactive to 2024).

You can read the official release from the Lt. Governor’s Office here.

PREVIOUS YEARS IMPORTANT CHANGES

PROPERTY TAX RELIEF BILL see our youtube playlist for local news snippets regarding.

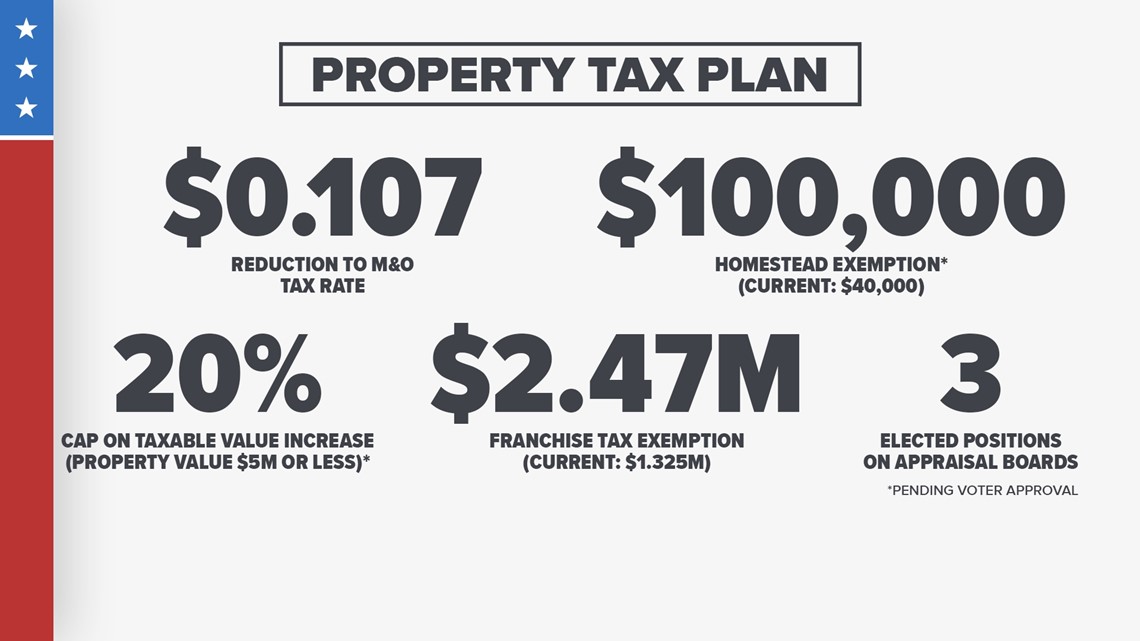

The $18 billion tax cut will include: passed senate, house bill 2 and 3 then 8/9/23 abbot signed off on for it to go on november ballot to pass

- Over $12 billion to be spent on reducing the school property tax rate for all homeowners and business properties by 10.7 cents

- Increase homestead exemption for homeowners from $40,000 to $100,000

- A 20% circuit breaker on appraised values as a three-year pilot project for non-homesteaded properties, valued at $5 million and under, including residential and commercial properties

- Savings on the franchise tax for small businesses and the creation of newly elected positions on local appraisal boards. It would increase the franchise tax exemption from $1 million to $2.47 million

- The resolution would create a three-year pilot program for all other property valued at $5 million or less, to cap increases on appraisal values

New Home Owner as of 2022 you do not need to wait to file for your homestead exemption.

Should you file right when you get in and possibly lose the previous owners exemption and cap? Checkout our workshop video #2.

The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

Read more here.

If you have a complaint against the ethics or professional conduct of a chief appraiser, appraiser or tax assessor-collector, you can file a written complaint with the Texas Department of Licensing and Regulation.

Help Change the System

**Go now to the new Texas Tax Transparency page to see who has the power to determine your property tax bill and tell them what you think! See when they are setting our tax rates and voice your opinion so we can lower this years bill. https://knowyourtaxes.org/

https://youtu.be/9KjHgmSbIRw?t=1235

MORE DETAILS ON TAX RATES CLICK HERE

Deadline (for most of us) is

🛑May 15th 🛑

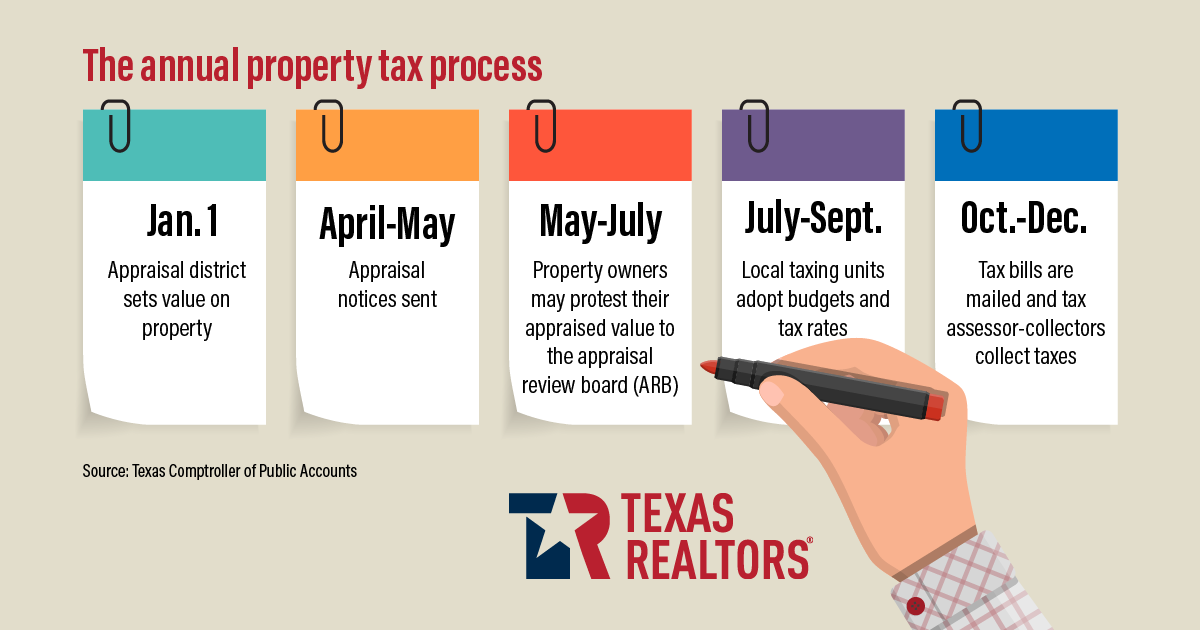

Deadline will be on notice and is 30 days after they mail it. Typically you'll receive mid April with deadline in May. ARB hearings start the end of May and go till July.September hearings for tax rates and budgets to be set. October tax bills mailed. January tax bills due.

💡 Pro Tip :

Missed the protest deadline? Texas law gives you a second chance — if you can show ‘good cause,’ you can still request a hearing. There’s no special form, but we can help you submit a request the appraisal review board may accept.

COLLIN COUNTY

- To file protest the new portal to efile in 2025 is https://onlineportal.collincad.org you have to create a new account this year so have your 2025 Notice of Appraised Value sheet infront of you that has your Property ID and your EFile PIN portal https://www.dentoncad.com/public-portal/sign-in

- More information on their site

- Help Desk Traning from Collin County with Links Videos https://ba.bisconsultants.com/end-user-training/

- Collin County Texas Property Taxes - (tax-rates.org)

Collin CAD:

Collin Central Appraisal District

250 Eldorado Pkwy

McKinney, TX 75069

DENTON COUNTY

- To file protest which they now call an "appeal" go to their eFile portal https://www.dentoncad.com/public-portal/sign-in

- Informal Hearings waitwhile.com/locations/dcad/welcome

- More information on their site dentoncad.com

Denton CAD:

Denton Central Appraisal District

3911 Morse St

Denton, TX 76208

TARRANT COUNTY

- Automated online protest through the Tarrant Appraisal District website

- Informal in-person protest (no appointment needed, just walk into TAD's office)

- Formal Appraisal Review Board (ARB) hearing (file a protest on the back of your blue value notice)

Links and Resources in Video

- Checklist to find and fix property condition issues

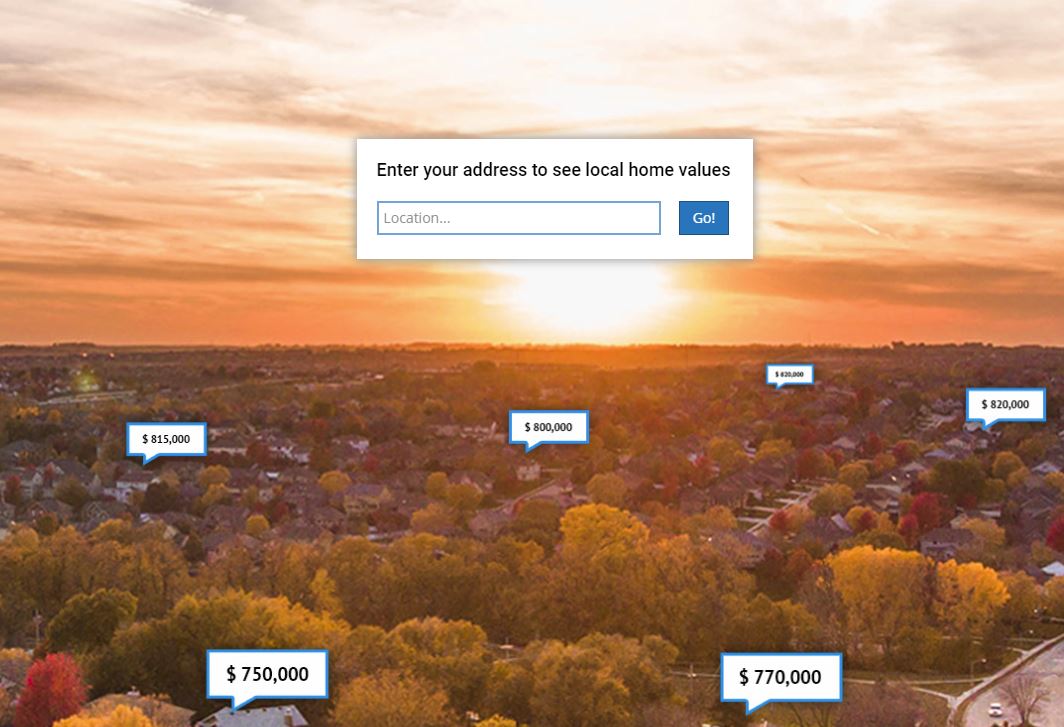

- Use this property tax calculator to see exactly how much the change in value affects your wallet

What to do?

Protest Protest Protest

The two important numbers are the market value (which is an appraiser’s guess at a sale price) and the appraised value, which is what is multiplied by the various taxing governments to get your tax bill. Read the full Tax Code Section 23.01 here. see pdf here

There’s a 10 percent cap on the annual increase of your house’s taxable appraised (not market) value, but only for those homeowners with a homestead exemption. Make sure you've filed (see my property taxes page for the links) it's free and as of 2022 you can file anytime after you've purchased the property.Read more on caps here.

See more rolling live statistics here.

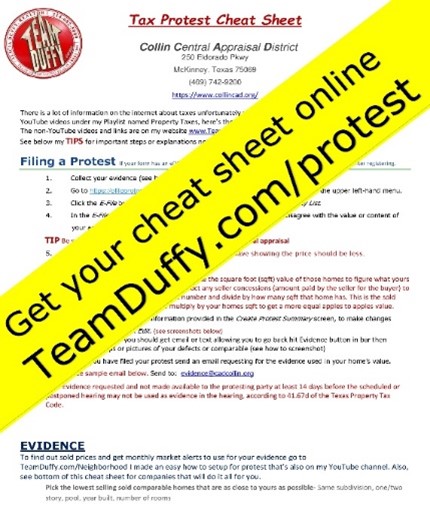

For more tips click below for our step by step

Protest Cheat Sheet & Presentation Excel Outline Updated frequently

Here are the best calculator I have found that figures in those exemptions:

https://taxpublic.collincountytx.gov/TaxEstimator

https://www.dentoncounty.gov/839/Property-Tax-Estimator

https://www.dallascad.org/TaxRateCalculator.aspx

📢 NEW FOR 2026: I'm Testing PropertyTAX.io

This is the first year I'm personally using PropertyTAX.io to handle my own property tax protests. As a realtor who's been guiding clients through this process for years, I want to see how a professional service compares to the DIY approach.

I have used this company for many years to do a quick check to see what their algorithm says my chances are and sometimes as part of my evidence, there fees seem pretty straight forward and you don’t pay unless they lower. Here’s discount code they gave me to lower the fee if they win Promo Code: P42561 but either way it's free to just put your house in and get some quick stats.

Why I'm trying it:

-

✅ They handle everything (filing, evidence, hearings)

-

✅ No upfront cost - only pay 35% if they reduce my taxes

-

✅ Fee capped at $350 for homes like mine

-

✅ Automatically protests every year until I cancel

I'll be documenting my experience and sharing results with everyone who subscribes to my updates. Want to follow along and see if it's worth it? Or considering signing up yourself?

⚠️ Important: This is a commitment that auto-renews annually. Read the contract carefully (see my review notes below). I'm testing this to see if the convenience justifies the cost vs. DIY.

Still want to DIY? 👇 Keep scrolling for my overview of the process and click here for my complete step-by-step cheat sheet, videos, and comps...

Directly from the ARB: TEXAS IS A NON DISCLOSURE STATE. You are not required to tell them how much you paid for the house.

Exemption & Rendition CycleARB Protest & Roll Certification Cycle

|

|

Basics on How to Protest in Collin County

Online Collin CAD https://onlineportal.collincad.org/

For more tips, comps, detailed how to our Protest Cheat Sheet.

INFORMAL HEARINGS ARE BACK SO TAKE ADVANTAGE OF THIS ONE ON ONE WITH APPRAISER!

File a protest well before the deadline in case of computer glitches. One popular method is to get comparable sales numbers from a Realtor or from the appraisal district (some will give if you ask). Then show their numbers are out of whack. See below options from Alicia.

Another more time consuming method is to find someone in your neighborhood with the exact same house plan. Check their numbers on the appraisal district’s website. If their numbers are lower, show that in a protest. Bring photos and copies of their tax records (available for free on an appraisal district’s website). You win.

Or if you have house problems like a hail-damaged roof or foundation cracks that need fixing, get estimates and show those to prove your home’s value should be lower.

Did Your Property Sustain Damage During Winter Storm? Click here for Collin CAD Press Release

You can even hire an outside company to protest. More information about those on my Protest Cheat Sheet.

Texans have a legal right to equal and uniform taxes. But the system is set up so the property owner must appeal to protest an assessed value.

A request for an informal hearing then if not satisfied start process online. If you have a eFile number in the top right hand side of your notice then you can file electronically!

See cheat sheet below for detailed steps and examples.

A property owner should present a simple and well-organized protest.

TIP: DON'T FORGET TO CHECK BOTH

Pictures are worth a thousand words – Take pictures of any disrepair on your property and of any “negative influences” surrounding your property. Qualified negative influences could be busy streets, water tower looming over your house, sewer plant nearby, commercial property bordering your residential, etc. Your noisy neighbor’s junked out car and overgrown grass probably will not qualify! Get estimates on everything!

Google Earth is a wonderful thing. I would recommend printing a satellite view of your property and the surrounding area. Probably 85% of the time you can find something negative to talk about on the image! It could be anything. Get creative and add support to the rest of your presentation.

Comparables-

3 ways to get a list of your properties sold comparables:

- Look up tax values by the appropriate county link below.

- Get our cheat sheet here with links to comparables. AND

- Enroll Free for my Your Neighborhood Market Alerts (below) to get monthly or quarterly reports of your areas activity including sold information. Make sure you go back on the days to Jan 1 of the previous year (so 450ish days). Good to keep quarterly so you can save homes that look like yours.

- Go to your counties appraisal district site or if efiled download their equity evidence to view your neighbors values for the comparables to print showing your home is not equal in value to your neighbors.

Formal Protest Mini Flowchart/Procedure - (for the detailed How To here)

Everyone should do a informal hearing first, see top of the page for my video walk thru and the recording of my meeting.

Property owner submits a timely filed protest with Collin Appraisal Review Board (ARB)Protest must be postmarked or hand-delivered by May 15th, of the current year or by the protest deadline on the Notice of Appraised Value. (If May 15th falls on a weekend or legal state or national holiday, the deadline will be the next business day.)

YOU WILL RECEIVE NOTICE OF AN OFFER, ACCEPTANCE OR THAT THEY HAVE NOT CHANGED YOUR PROPERTY VALUE

You'll then decide to reject and schedule the hearing or accept (finalizes process for this year).

Appraisal Review Board will schedule a formal hearing

Property owner will be notified 15 days in advance

Appraisal Review Board will mail a Notice of Hearing to the property owner

Property owner will begin collecting evidence for a hearing before the Collin Appraisal Review Board

Prior to attending hearing:

-

Property owner should finalize evidence

-

Property owner makes 1 copy of evidence for ARB (check your county confirm how many copies)

-

If you are not the property owner according to the district's record, you will be required to provide:

-

Proof of ownership, power of attorney, probated will, etc,

OR

-

If the owner hires a person who will be compensated to represent them, the Comptroller's Appointment of Agent for Property Taxes (Form 50-162) must be used.

If the owner has their spouse, family member or friend representing them at the hearing, please use the Appointment of Non-Agent Representation Form.

Day of hearing if in person

-

Bring evidence to hearing

-

Arrive on time

-

Check in at Appraisal Review Board desk In hearing panel:

-

Panel chairman will ask owner/district to state name

-

Both parties swear the evidence presenting is true and correct

-

Owner/district will have 5 minutes to present

-

Owner/district will have a few minutes for rebuttal

-

Same process for Market then Equity

-

Panel chairman will close hearing. The three-member ARB panel will discuss the evidence presented and render a decision.

After hearing:

-

In approximately 10 days, the ARB will send a final order by certified mail to the property owner.

-

Property owner may seek further remedies, if dissatisfied with the ARB decision. See additional information included in the final order.

If you don't agree with the protest results you can file an appeal for $500 to $1500!!! Really! Here's an attorneys explanation of the process from youtube, click here.

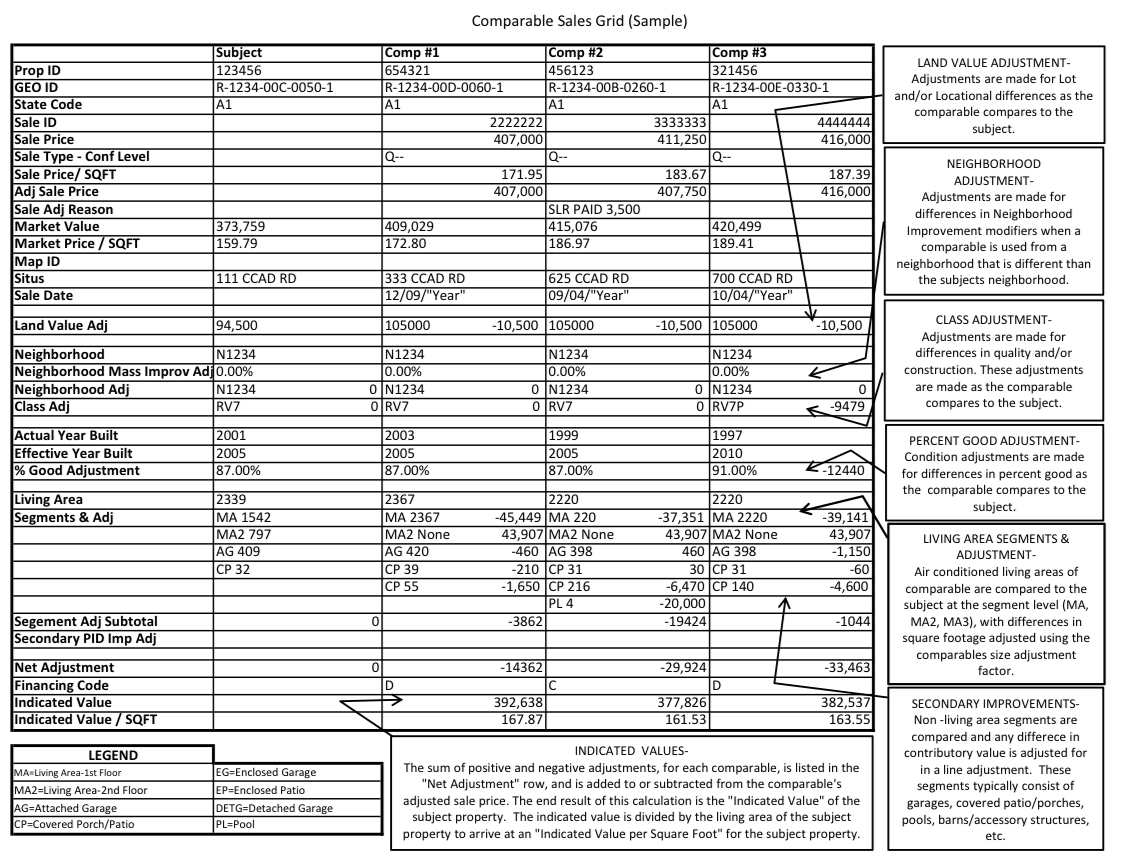

Counties explanation of comp sheet.

For more tips, comps, detailed how to our Protest Cheat Sheet.

DEFINITIONS AND LINKS

| APPRAISAL DISTRICTS: COLLIN COUNTY |

PROPERTY TAX SYSTEM:

There are four main parts to the property tax system. The appraisadistrict values property, administers exemptions, and maintains current ownership information on the appraisal records. The appraisal review board is a panel made up of people from the local community. They are independent from the appraisal district. They settle any disagreements between the appraisal district and the property owner about the valuation of the property. The governing bodies of the taxing units, such as the city councils, school boards, or county commissioners decide the annual budgets and set the tax rates. This determines the total amount of taxes to be paid. The tax office calculates the levy, mails the statements, collects the taxes and distributes the tax revenue to the taxing units.

Lookup Tax Codes https://statutes.capitol.texas.gov/

View the entire Texas Tax Code here

Texas Property Code Basics pdf

Collin County 2022 Budget

Tax Rates Property Tax Rates By State 2023 - Tax-Rates.org

Although this is from Parker County Weatherford it has a lot of very helpful information about the ARB https://iswdataclient.azurewebsites.net/protestprocess/parkercad/ARBInfo_PCAD_2021.pdf

Denton County click here

To view the details of the process from collin county click here to see their Press Release and https://www.collincad.org/files/Forms/CCAD-132.pdf

TEXAS COMPTROLLER

window.state.tx.us

Texas Comptroller how to video.

Collin Arbitration Board https://collinarb.org/frequently-asked-questions-faqs/

Exemptions https://comptroller.texas.gov/taxes/property-tax/exemptions/index.php

Denton County pdf is older but has a lot of good information in it. Click here.

For more tips, comps, detailed how to our Protest Cheat Sheet.

2022 Email from Collin CAD Residential Appraisal Manager answering my questions on what is considered maintenance or repair and getting estimates. I didn't find it helpful but you might. Click here.

How well is the ARB doing in listening to our concerns, evidence and lowering values? Here's the stats from dashboard for appraisal district operations.

Click below to go to site

❗️Missed the Deadline?

If you missed the May 15 protest deadline, you may still request a late hearingby showing “good cause.” While there’s no updated application form provided by the CADs in 2025, many property owners have successfully used the prior year’s form.

📝 You can download that here:

Collin CAD Good Cause Late Protest Request Form (2023)

👉 Tip: Be specific and detailed about why you missed the deadline — health, family emergency, CAD mailing delays, etc.

⚠️ Note: Approval is not guaranteed, and each ARB reviews these on a case-by-case basis.

CHANGE THE SYSTEM WHILE ALSO LOWERING YOUR FINAL BILL

💗Help Change the System

- CONTACT your officials by phone or email to VOICE your opinion and ask for rates to be lowered: Provide feedback to them directly on the Texas Transparency page just put in your homes information and it will tell you what entities tax you, when their hearings are and allows you to provide feedback for each. Go directly to the page here. Or see my video clip on what to do. https://knowyourtaxes.org/

- Fill out the survey they mailed out with your protest results. https://www.surveymonkey.com/r/surveyarb

- Attend the meetings on setting the tax rate and budget.

Contact information for all members of the Texas Legislature can be found at Texas Legislature Online. See last years below.

https://www.collincountytx.gov/tax_assessor/Documents/GOVERNING%20BODY%20CONTACTS.pdf

Contacts for all the entities that tax your home (not necessarily the elected officials themsleves) are listed for your home on the Texas Transparency in Taxing page here.

PLANO CITY COUNCIL MEETINGS

Watch them on Plano's website at www.planotv.org and Facebook.com/cityofplanotx.

To view previous meetings click here for the Collin County government site. To pre-register to speak at the City Council meeting, visit https://forms.plano.gov/Forms/Sign_Up_Citizen.

Emails regarding agenda items may be submitted to: councilcomments@plano.gov.

Wishing us all good luck! Feel free to call me with any quesions, join our Facebook group or Follow us

Alicia Duffy 214-682-5009