Calculators

🏠 For Home Sellers

Calculate your walk-away cash and see your new purchasing power for an upgrade in one step.

Skip the guessing game—get your home value in 2 minutes here.

🔑 For Home Buyers

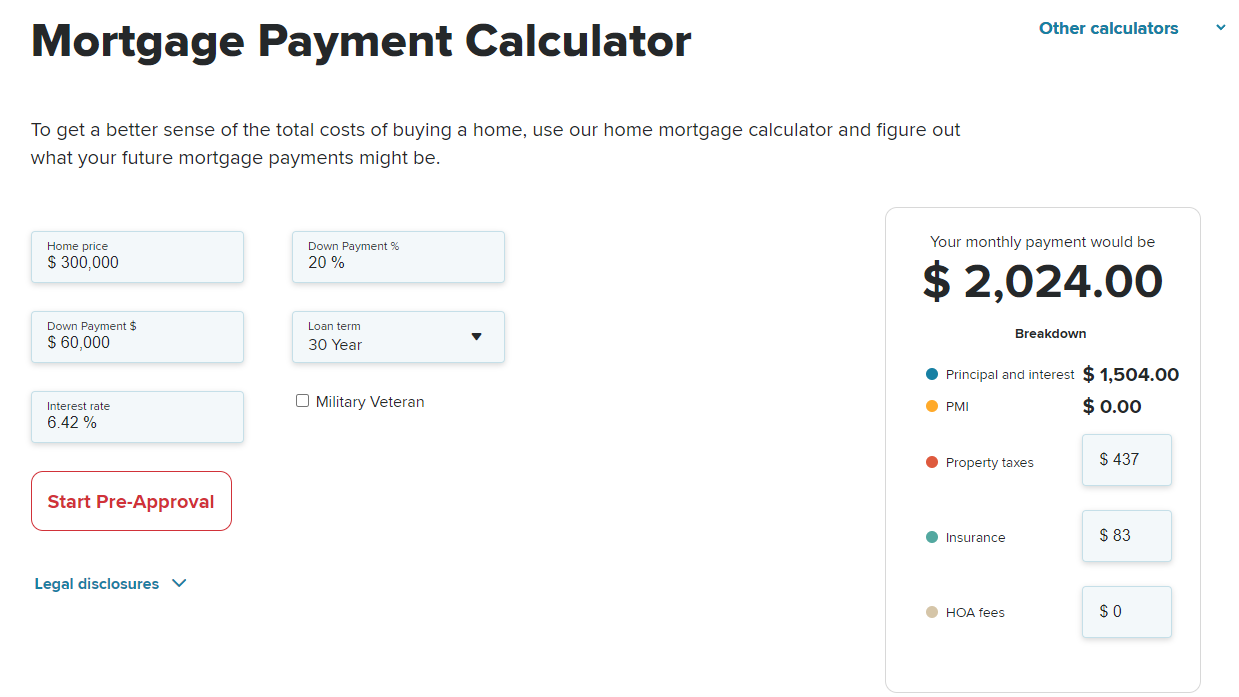

Find your estimated buying power based on your ideal monthly payment.

Property Tax Calculator for Collin County

|

|

|||

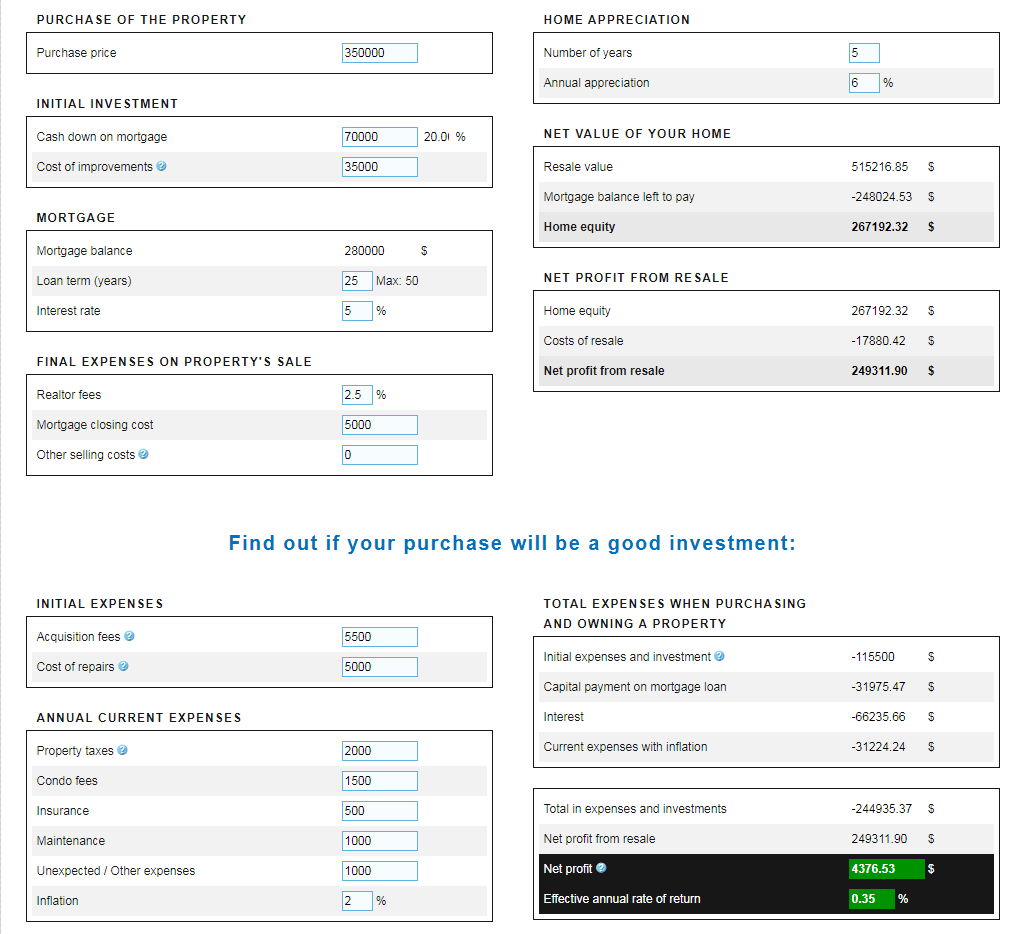

Please change the suggested values with your own amounts in the blue text boxes. This calculator links to https://www.creditfinanceplus.com/

Notice: This mortgage rate tool is an external widget provided for your convenience. TeamDuffy is not affiliated with the lender mentioned above.

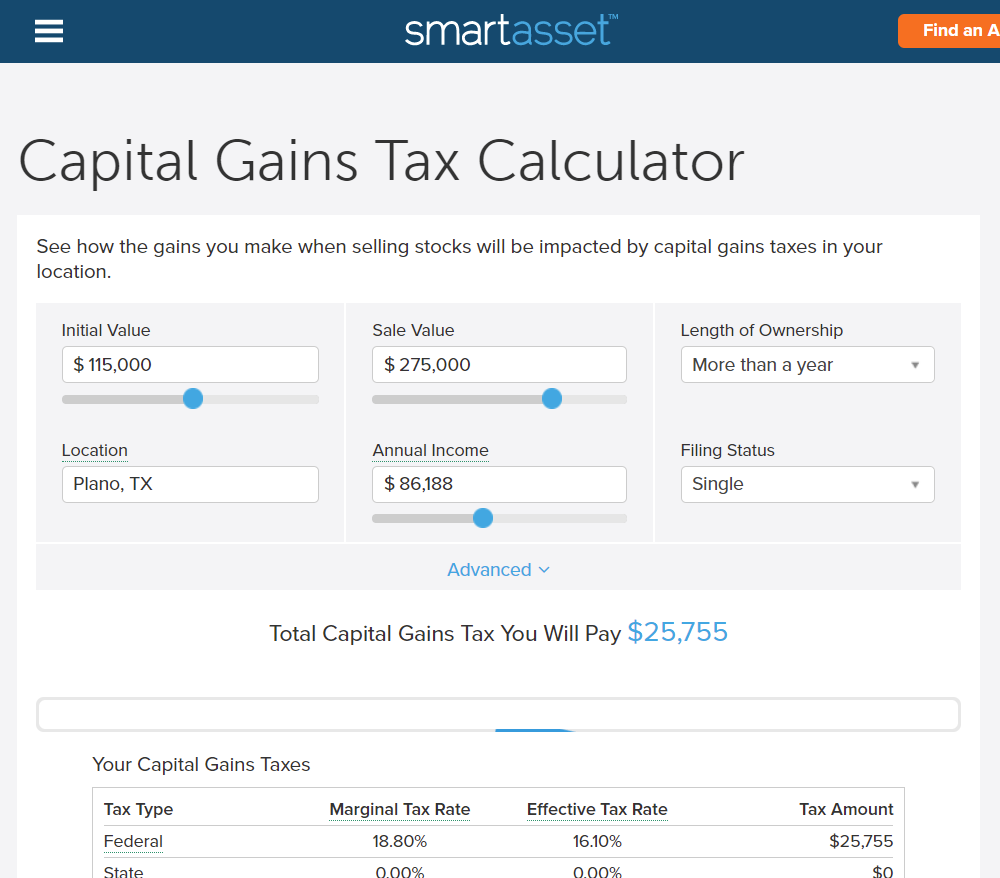

Capital Gains Taxes on Property

If you own a home, you may be wondering how the government taxes profits from home sales. As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller's basis.

Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains. When you sell your primary residence, $250,000 of capital gains (or $500,000 for a couple) are exempted from capital gains taxation. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale.

If you inherit a home, you don't get the $250,000 exemption unless you've owned the house for at least two years as your primary residence. But you can still get a break if you don't meet that criteria. When you inherit a home you get a "step up in basis."

Say your mother's basis in the family home was $200,000. Today the market value of the home is $300,000. If your mom passes on the home to you, you'll automatically get a stepped-up basis equal to the market value of $300,000. If you sell the home for that amount then you don't have to pay capital gains taxes. If you later sell the home for $350,000 you only pay capital gains taxes on the $50,000 difference between the sale price and your stepped-up basis. If you've owned it for more than two years and used it as your primary residence, you wouldn't pay any capital gains taxes.

Nice, right? Stepped-up basis is somewhat controversial and might not be around forever. As always, the more valuable your family's estate, the more it pays to consult a professional tax adviser who can work with you on minimizing taxes if that's your goal.