What Are Real Estate iBuyers Anyway?

Over the last few decades, we have all seen yellow handwritten signs posted to poles stating “We Buy Ugly Houses” or “We Pay Cash For Houses”. This was a low tech equivalent to today’s technological iBuyer program.

In our market, Plano, Texas and DFW metro area, we have three real players. Opendoor, Offerpad and Zillow. Zillow just entered the iBuyer game. In a statement, an iBuyer will buy your home from you for cash, they are flexible with the closing date so that you can get your life organized around your planned move.

Their premise is very simple. You request an offer from them online to buy your home. To bring the concept down to the simple bottom line, real estate iBuyers are a modified version of house flippers. They are buying your home looking to sell it for a profit.

iBuyers – How Do They Work?

Of course, every real estate iBuyer’s program is going to be somewhat different than the others, but the concept is the same; even going back to the old “We Pay Cash For Ugly Houses” programs. By the way, those programs are still around.

In theory, it is very simple. In practice it is a little more complex than it appears on the surface. When you, as an interested home seller, want to receive an offer from an iBuyer, you go to their site and request an offer from them.

Real estate iBuyers use proprietary algorithms to come up with an initial offer. Their computer programs will look at what your home is and the neighborhood it is in. This information is taken from public records and the local multiple listing services (MLS) if your home has ever been sold in the past.

The computer will then compare the information that it has on your home. It will be compared it to any homes that are for sale and have sold in your area over the previous six months. Let’s say that in its current condition, your home may realistically sale for $290,000. The real estate iBuyer may offer you $284,000 for your home. They will email an offer back to you.

The offer may look interesting to you. That's where your experienced agent like Alicia Duffy (shameless plug) comes into play to help get those initial numbers up, present it correctly and of course know what each one is looking for since we partner with several of them.

Did you know Opendoor is even coming up with a similar plan like Knock where you can as a buyer offer cash on a home you want and they'll back up the money. Interesting stuff here but shhh on that last one it's not been announced yet! If you're thinking of a move though or know someone who is I'll tell you all about it

during our timeline creation pow-wow! But back to the iBuyer companies for the home you're selling. It will save you the time it takes to prep your home for sale. It will also let you work your move from your timeline as the real estate iBuyer will be flexible with you on the closing date.

iBuyer – What Is Next?

Initially, the real estate iBuyers’ software program works up a valuation on your home. It works pretty much like any other online home valuation. Now that you have their highest offer, the real research begins. The iBuyer will make an appointment with you to actually come and give your home a visual inspection. What they are looking for is what must actually be done to your home. They need to sell it for a much higher market price than you were offered. Remember, these companies are in the market to make money from your home.

In most cases, they will paint the interior, redo flooring if needed and update the lighting and plumbing fixtures. They will often paint the outside and spruce up the landscaping. The home is not usually renovated to the level you see on HGTV or what other home flippers might do. Just enough into the house to get a good return. They need for it to sell quickly and profitably.

iBuyer – Discounts Off The Price

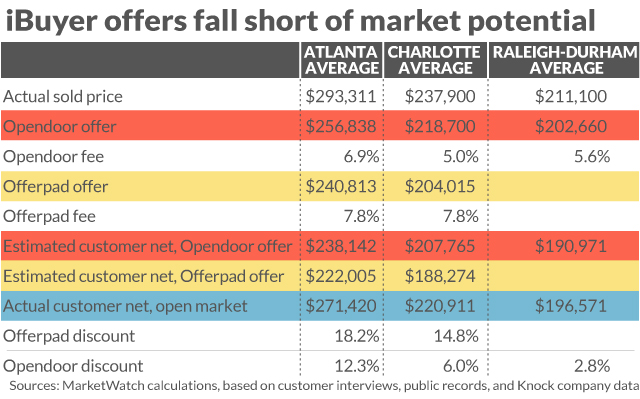

After the home has had a visual inspection, the iBuyer works up the formal offer you will receive. This offer usually starts with the price initially offered and then is discounted for all the costs and expenses they will incur. Typically, this is a 6% commission, plus a 1 to 3% discount for carrying costs and discounts for other repair fees that they will incur.

I recently met a young family at an open house I was holding a few Saturdays past. They were searching for a replacement home and told me they had just sold their house to one of the top iBuyers in the area. They explained that they are moving because they wanted to be closer to work.

I asked about their house that was just put under contract with the real estate iBuyer. They told me it was 3 years old, disclosed the neighborhood and the model. The home was almost new and featured lots of upgrades with almost no work needed. I asked them why they decided to sell to the real estate iBuyer? I was told that the iBuyer had offered them within about $4,000 of the actual worth of the home and that they would not have to keep the house clean to show it. The family had four young children and they were worried about keeping the home clean for showings.

The family told me they would walk away with a check from the iBuyer for $39,000. They said their mortgage amount was $250,000. So, in essence, the real estate iBuyer paid them a net of $289,000 for the home.

I just closed another seller client in Plano off Appomattox but during our get bids from all the iBuyers I also include all of my investors from way back in my foreclosure agent days and sometimes they beat out these companies by far, sometimes they fall short

well this time they beat them and they made a nice profit difference. Although they would have made a lot more money letting me bring in my contractors stage it and put on the open market but it was more than they wanted to do so we went with the the best deal

for them! That's my job is to get you the highest net from all the different kinds of buyers so that you can make the right decision for your family!

iBuyers – Great Deals or No?

That all depends on your perspective. The seller did not have to show the house or keep it clean and orderly. They had a flexible closing date so that he could move when he needed to. Those are both great advantages. But what did this family give up?

I looked up the like models in their neighborhood that had sold recently, and found that they were selling for about $335,000. If they had chosen to put in a little effort to get the home cleaned up and keep in that way for a few weeks, they would have netted quite a bit more. Most of the homes like theirs were selling within 7 days of going on the market.

If the sales price would be $335,000, he would pay a 6% commission split between the listings and selling agents and then would incur about 1% in closing costs with the title company. Minus the estimated 7% in fees and his $250,000 mortgage is paid off, they would have walked away with a check for about $61,500, or approximately $22,500 more than they did.

Was the convenience they encountered worth $22,500? Possibly to some people, but probably not to most. You see, as a homeowner, that additional money is tax-free. For most people, they would have to earn about $30,000 or more in order to net $22,500 after tax.

The Initial Offer Looked Enticing

The original offer from the iBuyer looked enticing, but by the time all of the costs and discounts were factored in, it was far less attractive than it first appeared. I have now talked with quite a few sellers who have used a real estate iBuyer to purchase their home. They all have stated the same advantages of a quick offer and no inconvenience.

Once the real estate iBuyer engages a potential seller, they, like any other negotiator, point out the advantages of using their service, but somehow leave out the costly disadvantage – how much money the seller really can put in their pocket.

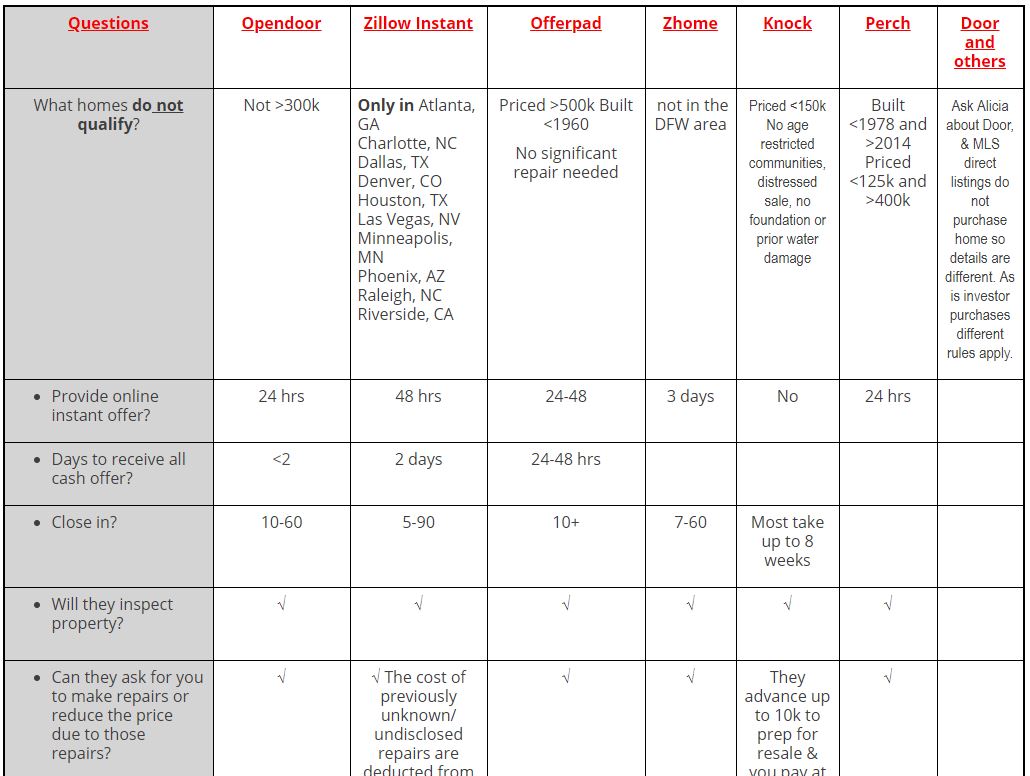

I've spent many hours researching all of these companies, getting offers from them and working with them as partnering agents. See my comparison chart page for these iBuyers.

Today, you have options when it comes to selling your home! Is a real estate iBuyer right for you? Only you can answer that question. There is no doubt that today’s technology and deep pocket investors have come up with a great plan. A plan to create convenience for a home seller. Home sellers need to keep in mind that this is a business proposition for profit by the iBuyer. The iBuyers are in business to make money. By offering some added convenience to getting a home sold, they often take a very large chunk of the home sellers hard-won equity.

Is it worth it? To some, yes! To most, probably not if they really knew how much they are forfeiting. The numbers presented to the seller by the iBuyers are typically skewed to look like it is a great deal and that they iBuyer is almost giving them full price.

There is always risk involved in flipping homes. The iBuyers could not afford to offer a buyer a price that would leave them little if anything on the table for profit. The example I used in this post is a realistic one. I also came across one a few months ago, where the seller forfeited more than $28,000 to the real estate iBuyer.

Stay informed! Invite an experienced real estate agent over to talk with you. This should be done BEFORE you have received your net offer from the iBuyer and before you sign the deal. Have the agent walk through how much you are really giving up by doing the deal with the iBuyer. If the deal is good enough for the real estate iBuyer to go through with it, given the risks involved, it is also something you should closely look into before handing over your equity.